- Home

- General Info

- Solutions

- Overview of Cheque Clearing and Processing

- Cheque Truncation System (CTS)

- Cheque Fraud Solution

- Cheque Book Issuing Systems

- Cheque Entry Solutions

- Cheque Encoding Solutions

- Outward Clearing Solution

- Automated Cheque Settlement

- Inward Clearing Solutions

- Cheque Archival Solutions

- Teller Cheque Deposit Solution

- Products

- Support

- Company

Cheque Archival Solutions

Cheque Archival Solutions

Challenges in Today’s Processing of Cheque and Remittance Advices

Many organisations and institutions today still receive paper cheque and remittance advices in large numbers. These documents come from within their own organisations or from other institutions at metro, regional to rural offices. Processing these documents is a tedious job and requires involvement of multiple parties, some are third parties. Such multi-layered involvement in remittance advice and cheque processing doesn’t only delay settlement, but it also increases the risk of human errors—leading to steep increase in operational costs.

Overview of SMARTCAPTURE™ Solutions

Introducing SMARTCAPTURE™, a user-friendly application designed to simplify and streamline the processing and archival of cheques and remittance advices.

Using SMARTCAPTURE™, cheques and remittance advices can be scanned and read, not only for archival or record-keeping purposes but also for further processing. Cheque data and images can be transmitted electronically within and across institutions, intra- and interbank, reducing overheads in operations, transportation, and physical storage space, and minimising risks of discrepancies and losses during handling. Furthermore, electronic cheque data can be easily backed up and restored, providing flexibility in managing your data recovery centre.

SMARTCAPTURE™ offers comprehensive solutions to address the challenges in cheque and remittance advice processing, including:

| Challenges | Solutions |

|---|---|

| Cumbersome processing of paper cheques | Solved |

| Mitigation of discrepancies and losses | Solved |

| Reduction of high processing costs | Solved |

| Expedited settlements | Solved |

Various Cheque and Remittance Solutions

Discover diverse solutions for efficient cheque and remittance processing to meet various business requirements.

Key Features of SMARTCAPTURE™

SMARTCAPTURE™ boasts capabilities including:

Automated Double Verification

Utilising MICR and OCR technologies: With MICR and OCR read sensors embedded in the scanner, SMARTCAPTURE™ ensures dual control over processed cheques and remittance advices, speeding up the document processing while reducing the risk of financial losses.

Archival Mode Options

SMARTCAPTURE™ allows scanning of documents in various combinations, including:

- One remittance advice followed by one cheque

- One remittance advice followed by multiple cheques

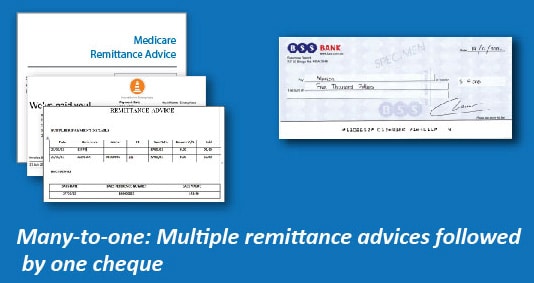

- Multiple remittance advices followed by one cheque

B/W, Greyscale, or Colour Image Capture

SMARTCAPTURE™ captures, processes, and stores data and images in various image settings—B/W, greyscale, or coloured images.

Fully Automated Image and Data Workflow

SMARTCAPTURE™ offers a completely automated image and data flow from scanning of cheques and remittance advices, document authentication, batching, and balancing of transactions for further processing.

Basic to Advanced Search Tool

Retrieve data from the electronic document archive using keyword/value search or range value search, enabling easy verification of suspected discrepancies at point of presentment.

Exportable Data

Data stored in SMARTCAPTURE™ database (archived data) can be exported into file format for further processing or backup purposes.

Compatibility with a Wide Range of Check21 Scanners

SMARTCAPTURE™ is compatible with a wide range of document or cheque reader scanners of Check21 standard, accommodating both manual feed and auto feed document scanning without customisation.

Benefits of Using SMARTCAPTURE™

SMARTCAPTURE™ enables your organisation to:

Simplified Settlements

Simplify end-of-day settlement with point-of-presentment cheque processing

Extended Deposit Hours

Increase customer satisfaction by extending deposit cut-off hours

Accelerated Processing

Speed up the handling and processing of cheques and remittance advices

Streamlined Operations

Streamline entire operations by eliminating multiple handling

Reduced Costs

Reduce unnecessary costs resulting from human error associated with manual intervention and maintenance of separate remittance advice and cheque inventories

Expedited Decision-Making

Accelerate decision-making with increased audit and disaster readiness

Proactive Discrepancy Anticipation

Anticipate any potential discrepancies and disputes at point of presentment